Whether it’s for yourself or someone you care for, long-term care is an issue that we need to confront. When the time comes, most people will need help paying for care.

This article presents three strategic models and options for paying for the cost of long-term care, whether leveraging a retirement or investment account. Your specific objective will determine which model works best for your situation.

Not everyone needs long-term care insurance, but the majority of us will need care. How your care is paid for is up to you and your financial situation.

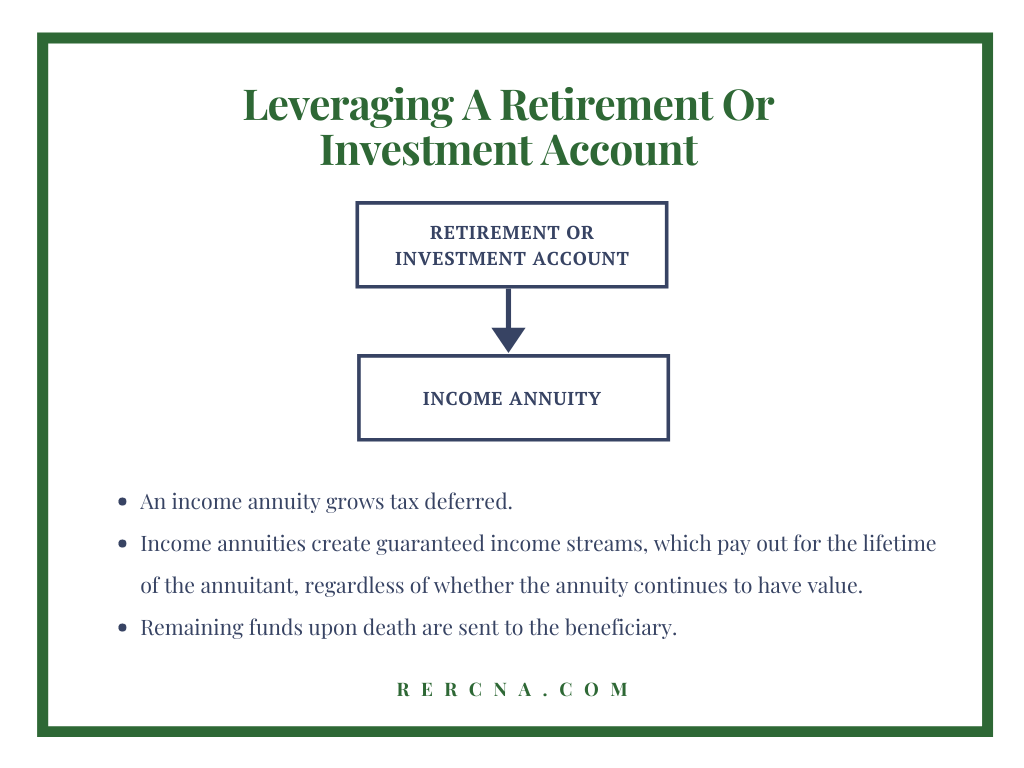

Leveraging a Retirement or Investment Account

Most people need to use their retirement or investment account to pay for long-term care, whether it’s through an insurance policy or directly from their account(s). Leveraging your retirement or investment account to create an income annuity is an effective way to minimize the cost of paying for a long-term care insurance plan.

Using an income annuity is the least expensive way of paying for long-term care insurance.

Each of these three models is designed to accommodate different needs and objectives.

Model 1: Funding a Traditional Long-Term Care Policy

In model 1, an income annuity funds a traditional long-term care insurance policy. Generally, once a traditional long-term care policy is in claim and the elimination period is satisfied, the premium is no longer required; however, the annuity continues to pay out. This model leverages a portion of a retirement or investment account and returns nothing to the beneficiary or estate.

Model 2: Asset-Based Funding

In model 2, an income annuity funds a traditional long-term care insurance policy. Once the long-term care policy is in the claim process and the elimination period is satisfied, the LTCI premium is no longer required; however, the annuity continues to pay out. Upon the insured’s death, the life insurance policy proceeds will reimburse the beneficiary/estate for the money used to fund the annuity.

Model 3: Hybrid Asset-Based Life Insurance with LTC Rider

In model 3, an income annuity funds a traditional long-term care insurance policy. The life insurance policy has a qualified LTC rider attached that mirrors the face value. If you are receiving care at home, going to day care, or living in an assisted living or a skilled nursing facility, the LTC rider will provide a source of funds up to your monthly allowance until the policy is exhausted. Funds that are not utilized for long-term care are distributed as a death benefit and paid to the beneficiary or estate.

Our help line is there for you.

For assistance to determine the model that best fits your situation, please feel free to reach out to one of our certified long-term care specialists to discuss your situation.

Phone: 617.982.3692

Email: info@rercna.com

Attend a webinar: visit rercna.com to view the schedule and register.