Downside protection is a feature found in all fixed index annuities. Not only are the funds protected from market volatility, but for those with annual crediting methods, the funds lock in on the annual anniversary and will never be reduced due to market volatility.

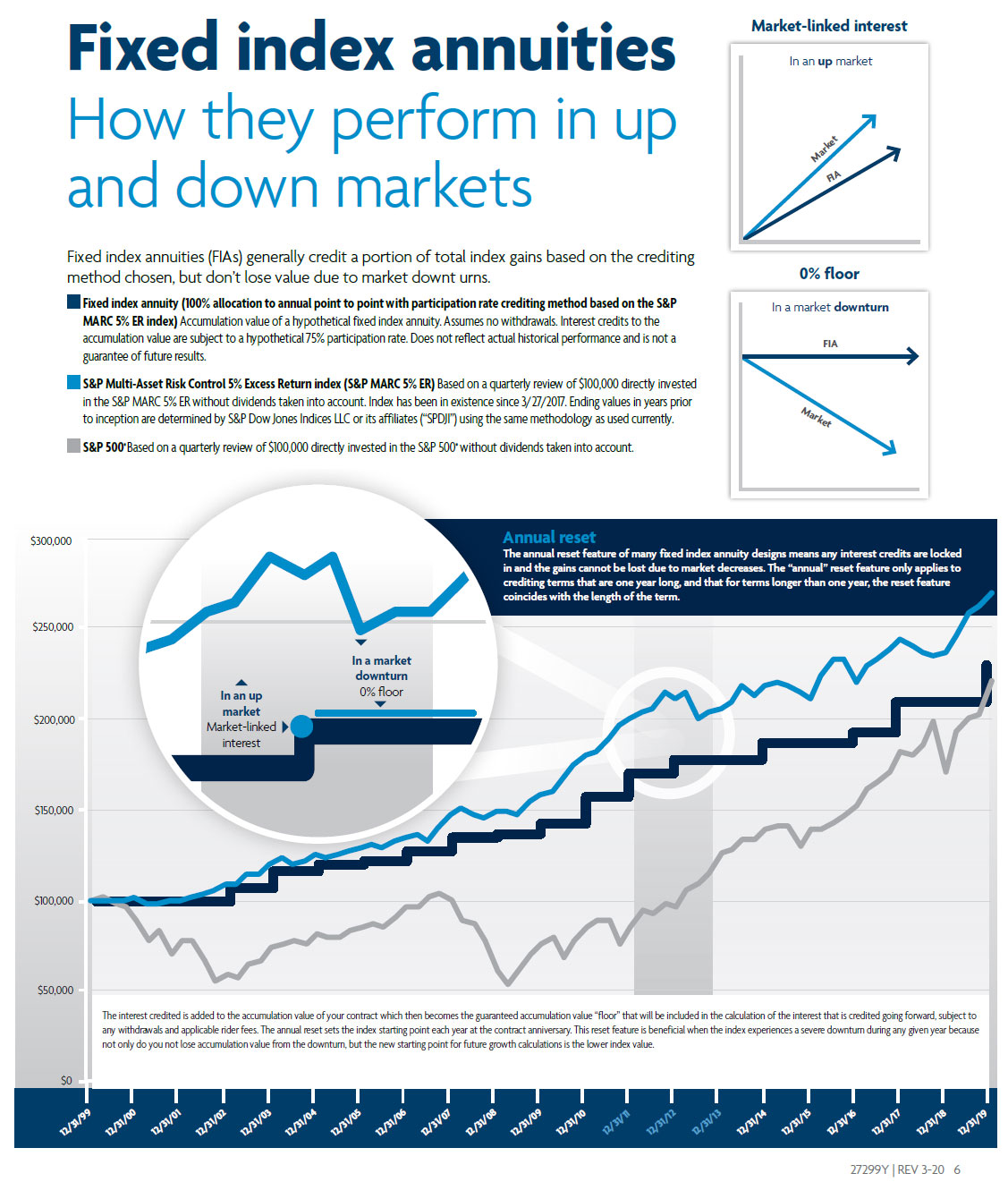

During the course of the year, the indexes can change, up and down, and are reflected within the allocated index, sometimes averaged and other times compared annually based on the beginning and ending values. Regardless of the method used, at the end of the contract year, if the allocations were to reflect a negative impact on the contract, no growth and no loss would be applied to the contract.

Fixed index annuities are long term insurance products with guarantees backed by the issuing company. In general, the purpose for insurance products is to help provide protection, and for annuities to also provide guaranteed lifetime income. As mentioned earlier, downside protection is a feature built into fixed index annuity products.

Fixed index annuities provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturn or fluctuation. When funding a fixed index annuity, selecting one or more allocations is required. Although the allocations address indexes referenced in the financial market, fixed index annuities are not a direct investment in the stock market. The allocated index is used as a barometer to help determine the value applied to the contract. With that said, a fixed index annuity credits interest to the annuity contract value based upon the movement of the underlying market index. Growth of the fixed index annuity is calculated based on the index and it is linked to how that index performs.

Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index. Depending on the product and the allocation choices, some indexes’ allocation growth is capped, while others subtract a predetermined percentage, commonly referred to as a margin or spread, before applying growth to the contract. For some crediting methods, the interest credit percentage is calculated by multiplying a specific percentage by the percentage change in the index value. This percentage is referred to as the “participation rate”. All contracts offer a fixed allocation that guarantees the growth in a given year and do not have caps or margin/spreads. The interest rate is declared at the company’s discretion each year thereafter but will never be less that the minimum guaranteed rate provided in the contract. These allocation elements adjust when needed, based on the economic environment, allowing the insurance company to manage and navigate its portfolio during a difficult economy. During a good economy, caps go up, margin/spreads go down, and participation rates adjust accordingly. Based on the allocation period, one or two years, contract owner can change allocations. Some allocations allow the contract owner to lock the contract growth for the remaining period, others leverage a negative market, and some limit the volatility and growth systematically.

The chart demonstrates through historic data the power of downside protection. Based on the S&P 500, when the market is high, funds with downside protection have met similar expectations, and when the market is falling, the funds hold steady, eliminating the stress of the roller coaster ride.

Retirement funds (401(k) type accounts) can be placed in an annuity upon the separation from an employer or any time after age 59½, while employed or not. Funds outside of retirement plans such as stocks, bonds, cash on hand can fund an annuity at any time. The most important aspect of fixed indexed annuities one needs to understand is that whether the objective is to accumulate value, create income, or both, the funds have upside potential while being protected from market risk.

Although fixed index annuities may not be appropriate for everyone, for some, downside protection can add great value to a portfolio, especially when individuals have a retirement date in mind and uncertain times force them to change directions. For example, if you were planning to retire in April 2020, when the market is experiencing a market downturn, using funds reflecting the downturn may not be your best option. You may choose to reconsider retirement once the market recovers, which could be 7-10 years from now. If your funds were in a fixed index annuity, set up to provide a lifetime income stream, the funds would be protected.

Information presented in the post is general and for educational purposes only. For specific information pertaining to an individual situation, it is advised to contact a licensed insurance professional.

Please feel free reach out to Mark at 508-353-2524 or mark@mcardoza.com with any questions. I love what I do, and I would enjoy helping you with your own situation.

DR1128 (4/30/2020)